India's economy grew less than expected.

The Indian rupee Depreciated slightly amid differing monetary policies between the Reserve Bank of India (RBI) and the U.S. Federal Reserve. The RBI remains firm in its stance not to cut interest rates soon, as policymakers continue to prioritize inflation risks and are not fully convinced that the recent inflation data shows a significant slowdown. In contrast, U.S. economic data, including a weakening labor market and a marked decline in inflation, have led investors to anticipate multiple rate cuts by the Federal Reserve this year, which would further weaken the U.S. dollar.

India's economy expanded by 6.7% year-on-year in the second quarter, slowing from 7.8% growth in the previous quarter. This marks the slowest growth in five quarters, primarily due to a sharp slowdown in government spending, which has been delayed by election-related activities. However, the slowdown in consumer spending in India may further indicate a continued economic deceleration in the future.

India's Composite PMI stood at 60.7 in August, well above the long-term average of 54.6, marking the 37th consecutive month of expansion in both the manufacturing and services sectors. Notably, the services sector showed robust growth, while manufacturing growth remained modest due to rising production cost inflation and intensifying competition, which has put pressure on companies to keep prices competitive.

Inflation in India rose to 3.65% in August, higher than the forecast of 3.55%. Despite the increase, inflation remains below the RBI's target of 4%. The uptick in inflation was driven by rising food prices, which make up nearly half of the consumer goods basket, with notable increases in the prices of pulses and vegetables due to increasingly erratic weather and rising demand both domestically and internationally.

The yield on India's 10-year government bonds remains below 6.8%. With inflation below target and GDP growth slowing more than expected, investors anticipate that the RBI will cut interest rates in the fourth quarter, signaling a shift toward more accommodative monetary policy.

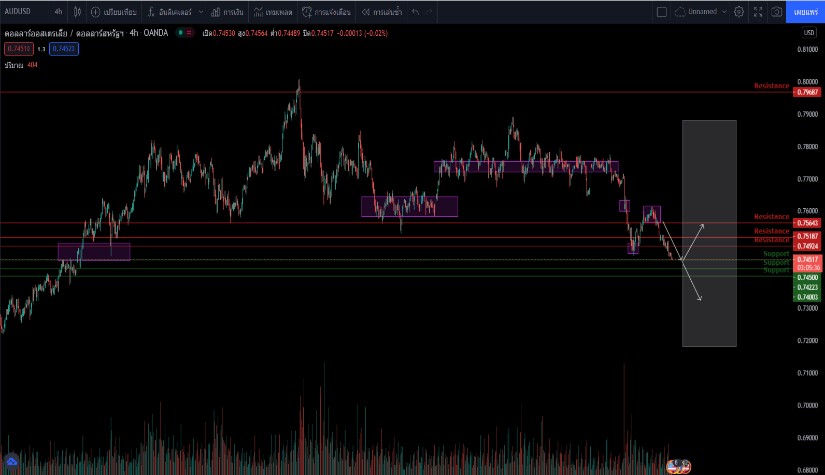

Techical analysis data (5H)

Resistance: 83.531, 83.578, 83.602

Source: Investing.com

Buy/Long 1: If the price touches support in the price range of 83.436 - 83.46 but cannot break the support at 83.46, you may set a TP at approximately 83.578 and SL at around 83.39 or according to your acceptable risk.

Buy/Long 2: If the price breaks the resistance in the price range of 83.531 - 83.578, you may set a TP at approximately 83.602 and SL at around 83.9 25or according to your acceptable risk.

Sell/Short 1: If the price touches resistance in the price range of 83.531 - 83.578 but cannot break the resistance at 83.531, you may set a TP at approximately 83.436 and SL at around 83.602 or according to your acceptable risk.

Sell/Short 2: If the price breaks the support in the price range of 83.436 - 83.46, you may set a TP at approximately 83.39 and SL at around 83.578 or according to your acceptable risk.

Pivot point September 20, 2024 11:21 PM. GMT+7

|

Name

|

S3

|

S2

|

S1

|

Pivot Points

|

R1

|

R2

|

R3

|

| Classic | 83.39 | 83.436 | 83.46 | 83.507 | 83.531 | 83.578 | 83.602 |

| Fibonacci | 83.436 | 83.463 | 83.48 | 83.507 | 83.534 | 83.551 | 83.578 |

| Camarilla | 83.466 | 83.473 | 83.479 | 83.507 | 83.492 | 83.499 | 83.505 |

| Woodie's | 83.38 | 83.431 | 83.45 | 83.502 | 83.521 | 83.573 | 83.592 |

| DeMark's | - | - | 83.449 | 83.501 | 83.52 | - | - |